By BM

Motorcycle taxis, commonly known as boda bodas, have become a vital means of transport across Uganda’s cities and towns.

But behind the convenience of quick and affordable rides, a worsening public health crisis is unfolding.

Hospitals are overwhelmed, families are devastated, and thousands of riders and passengers suffer severe injuries in accidents experts say are largely preventable.

At Mulago National Referral Hospital, the largest government hospital in Uganda, Dr. Justine Okello, the head of the Accident and Emergency Unit, explained that more than 75 percent of trauma cases admitted are due to road crashes, with boda bodas involved in over 60 percent of these incidents.

He reported that the hospital receives around 40 major trauma cases daily, many involving life-threatening injuries such as head trauma, multiple fractures, internal bleeding, and spinal cord damage.

Dr. Okello emphasized that treatment costs are often astronomical, ranging from 10 million to 50 million Ugandan shillings per patient.

While public healthcare is assumed to be free, families invariably bear the financial burden through medication costs, medical equipment fees, and long-term rehabilitation expenses, frequently leading to severe economic hardship.

Despite the critical need, most boda boda riders and passengers remain uninsured.

Marcos Erimo from the Insurance Regulatory Authority of Uganda (IRA) noted that insurance penetration in Uganda is below one percent.

He attributed this to prohibitively high premiums, widespread mistrust of insurers, and a common perception that insurance is an elite privilege.

This leaves riders exposed to significant financial risk, as many operate daily in high-risk conditions without any safety net.

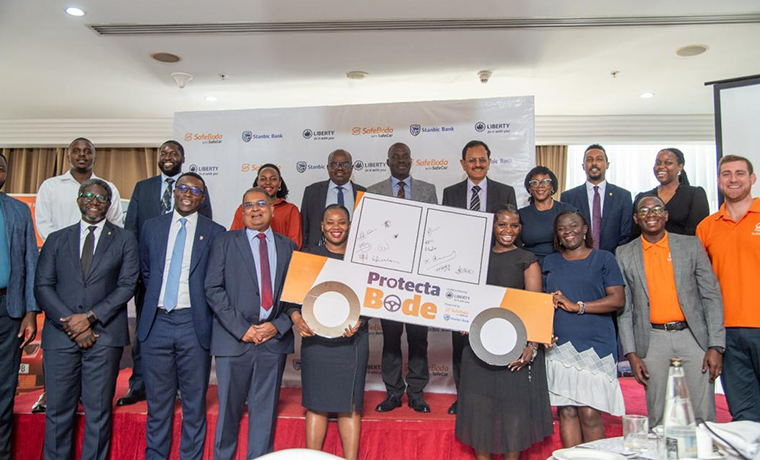

Aiming to address this urgent gap, Liberty General Insurance Uganda, led by Managing Director Peter Makhanu, in partnership with Stanbic Bank Uganda and Safe Boda, has launched Protector Body, an innovative micro-insurance product tailored for Uganda’s informal transport sector.

The product offers flexible, on-demand accident and medical insurance that can be activated digitally and paid via mobile money, making it accessible to boda boda riders and their passengers.

Peter Makhanu explained that Protector Body was created after realizing the devastating financial impact accidents had on riders and their families.

He stressed that traditional insurance models did not fit informal workers’ realities, which inspired the development of a product with affordable premiums and easy digital access.

Christian Wamambe, Country Director of Safe Boda Uganda, said the idea for Protector Body grew from Safe Boda’s experience with its earlier insurance product, Safe Ride, which insured millions of trips on their platform.

He highlighted how riders often disappeared from the platform after accidents or health crises, lacking savings or credit to recover financially.

Protector Body was integrated into the Safe Boda app to enable riders to quickly activate coverage and extend protection to passengers, who are usually even less likely to have insurance.

Stanbic Bank Uganda’s Executive Director and Head of Personal & Private Banking, Samuel F. Mwogeza, shared that the bank’s role includes underwriting support and providing the digital payment infrastructure.

He emphasized that with less than one percent of Ugandans insured, many live just one accident or illness away from financial disaster.

Protector Body, according to Mwogeza, represents a critical move toward meaningful financial inclusion by protecting the livelihoods of Uganda’s working population.

Marcos Erimo from Insurance Regulatory Authority confirmed that ‘Protector Body’ is approved under Uganda’s Insurance Regulatory Authority sandbox framework, allowing new products to be tested before wider market rollout.

He described the product as an example of the innovation the insurance industry needs, one that is built around local realities and developed in collaboration with the communities it serves.

At the product’s launch Sheraton Hotel in Kampala on Wednesday, stakeholders agreed that the boda boda road safety crisis in Uganda is urgent and escalating.

With over 4.5 million vehicles nationwide and an exponentially growing boda boda sector, risks have increased dramatically.

Public hospitals like Mulago, already strained by limited funding and staff shortages, face unsustainable trauma burdens.

Dr. Okello noted that while road accidents cannot be completely eliminated, their consequences can be mitigated through systems that provide timely, affordable care.

Insurance, she suggested, is a vital part of such a system. Stakeholders believe ‘Protector Body’ has the potential to become a national model for Uganda and other African countries confronting similar challenges.

By leveraging digital technology, behavioral data, and low-cost payment models, Protector Body is creating a pathway to protect millions of lives and livelihoods.

Early results show riders signing up, claims being paid, and trust beginning to build within the informal transport community.