By Mulengera Reporters

For now 15 years, Mbarara City-based Perfect Touch Salon owner Racheal has been a renowned salon operator in Western Uganda’s busiest and fastest growing metropolis.

She relies on her 26 employees to keep quickly attending to hundreds of women who keep flocking her much sought after salon to have their hair worked on. She always desired to expand and diversify into other business activities, but all this required patient capital which she lacked.

When she learnt of GROW project loans through a relationship manager at her Post Bank Mbarara branch, she saw the intervention as a God-sent opportunity and signed up. She was fascinated by the fact that, upon assessment, she was found to be eligible to take out Shs50m, at just 10% interest, and repayable in two years time.

She used some of the money to buy modern equipment and add value to her salon business as this was the only way to enlarge customer base by attracting new customers while retaining the old ones.

A restocked salon enabled her to become even more competitive as more customers came on since Ugandans always like trendy things. She now has two well-performing branches for her Perfect Touch Salon-one in Kizungu and another at Rwebikona.

Racheal says that another Shs25m (off the Shs50m loan from GROW) was used to diversify into the rice importation business, which she currently doesn’t regret expanding into.

Indeed, enabling female entrepreneurs expand, diversify their businesses while plunging into hitherto male-dominated business arenas is one of the core objectives for GROW project, which President Museveni came up with using funding (Shs850m) from the World Bank whose top executives become motivated even more whenever they see the resultant transformation manifesting through beneficiaries like Racheal.

Using the Shs50m, Ms Racheal (who had already been exposed and used to how borrowed money has to be productively leveraged) was also able to strengthen herself into recreation (guest house and restaurant) business. She is also grateful for the fact that the GROW project funds have enabled her to increase on her overall profitability, which has made life much easier for her as a female entrepreneur.

Because collateral was initially a key mandatory requirement for all GROW project beneficiaries, Ms Racheal used her land title as collateral to secure the Shs50m loan taken out of GROW. Her two friends, who are Post Bank customers, endorsed on the loan as guarantors.

NOT THE ONLY:

Yet Ms Racheal, the Perfect Touch Salon proprietor, isn’t the only female entrepreneur who has positively been impacted by the GROW project, which the GoU is implementing through the Private Sector Foundation Uganda (PSFU) whose Dr. Aisha Ruth Kasolo serves as the overall Coordinator.

There are several others like Florence, a hair dresser and cosmetics vocational trainer in Masaka City. She has been a hair dresser for 10 years and in 2023 went into vocational training too-chiefly focussing on the cosmetics industry. She also now has a vocational training centre, with 30 students currently enrolled already, to become professional hair dressers. She employs two other people to help in the training.

The Post Bank customer was given a loan of Shs5m under the GROW project and says that this money enabled her to invest in expansion of her business operations. She is grateful that with the patient capital availed under GROW, her business sustainability is now well assured. With her sister signing off as a guarantor, Florence used her business building as collateral to secure the loan from GROW.

Another GROW beneficiary is Wakiso’s Miriam, a well-established tailor who was boosted with a loan of Shs4m repayable back within 2 years and at 10% interest.

Even when her original desire for Shs6m was diminished to Shs4m, upon assessment, Miriam is grateful that she was able to make bulk purchases of materials used in making school uniforms, which she was able to engage in and make some good money.

She mainly depends on her own children for labor whenever they are in holiday. Otherwise, she has one other full-time employee she works with. She used her sewing machines as collateral to secure the GROW loan, which had her husband serving as a guarantor.

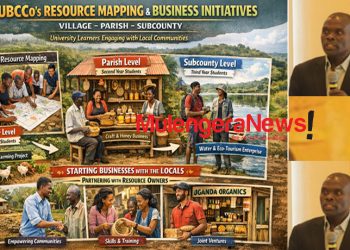

Teddy, a Kabarole-based honey maker and weaver of traditional baskets, was also supported with Shs5m from GROW. She has been weaving and selling all her baskets to Rwenzori Sustainable Trade Centre but with GROW-enabled expansion, she is now able to have enough to sell to walk-in clients too, which wasn’t the case before. This had boosted her earnings.

She says that there is growing demand for her baskets, which she is now able to produce in larger quantities than before. She is optimistic that by the time the one-year repayment period she was given elapses; she will fully have repaid the Shs5m loan.

She says she no longer has a backlog of orders because the Shs5m loan enabled her to expand her operations and enlarge her output in a given time. For collateral, she tendered documentation relating to her kibanja as security for the loan.

Agnes from Wakiso also has a good story about GROW. She is grateful that the Shs20m she borrowed from GROW enabled her to remain competitive in plumbing, which ordinarily is a male-dominated business activity.

For more than 5 years, she has been in the business and persistence has seen her transition from using boda riders for delivery to using a motor car.

She uses her children for labor during holidays, on top of the other one employee she works with. The seller of plumbing materials (like pipes, toilet seats, sinks, tiles and ceramics) is grateful that with GROW’s Shs20m she was able to restock, expand and stabilise her plumbing business.

She easily passed the assessment task to qualify for the Shs20m because she already had a savings account with Equity Bank through which her GROW loan was processed. For collateral, she used her land sale agreement and had one other Equity Bank customer signing on as a guarantor.

There is also grocery and retail shop owner, Tusasibwe from Luwero who benefited from GROW. She was able to use the Shs5m to make the necessary investment that qualified her to become an enrolled water supply agent for West Lake Water Company.

These days, she is able to hire a truck to ferry the water which she sells to community members in Luwero. This is additional to her grocery retail shop business. She employs two people to keep her water supply business going-namely a driver and turn boy.

She says that the GROW loan enabled her to fund the transport requirement to sustain the water supply business. She had previously been borrowing from the SACCO where she was a member-meaning the GROW loan wasn’t the first time she was borrowing.

For collateral, Tusasibwe used her land sale agreement and the business license too to secure her Shs5m loan from GROW. Her husband was supportive to the extent he signed as her guarantor. He also mobilized another friend to sign as a co-guarantor. (For comments on this story, get back to us on 0705579994 [WhatsApp line], 0779411734 & 041 4674611 or email us at mulengeranews@gmail.com).