By Otim Nape

For these five years (2021-2026) of government, Gen Museveni’s focus has chiefly been economically transformation millions of Ugandan households through Parish Development Model (PDM), an intervention through which each of Uganda’s 10,717 parishes is given Shs100m per year.

The money is to be lent out to hitherto economically-deprived households whose members have to belong to a SACCO. The idea is to transition such hitherto excluded households from subsistence to the money economy. They have to be induced into producing and selling or spending and purchasing something.

CONTRASTING WITH GROW:

Whereas PDM is for the very poor, the Museveni government has within the same period improvised and come up with another intervention aimed at economically emancipating those who aren’t poor enough to qualify for PDM.

These are individual Ugandans or households which are already engaged in some form of trading economic activity but require a push through access to affordable credit to be able to capitalize and expand their businesses.

Chiefly targeted to benefit and economically emancipate women entrepreneurs, who require capitalization but can’t viably borrow from the commercial banks, the intervention is called GROW (which in full is Generating Growth Opportunities & Productivity for Women Enterprises). It has come to famously be known as GROW project.

Whereas priority is on women-owned enterprises, men too can benefit from GROW mainly in two ways. One is if they are co-owners in a business enterprise where not less than 51% of the shareholding or ownership is in the hands of a woman or women. Men can also benefit and be impacted under GROW if they happen to be employees in such business enterprises.

GROW is a five-year project (January 2023-December 2027) whose total worth is $217m, which comes to Shs850bn in Ugandan money. The cash is from World Bank to the GoU which is implementing the project through the Gender Ministry and Private Sector Foundation Uganda (PSFU), which is implementing the part that was ordinarily meant for the Ministry of Finance.

The GROW project intervention seeks to help realize the GoU long term development objectives enshrined under the NDP-namely emancipating women into participation in leadership and economic decision making, while at the same time combating gender inequality. This inequality has historically disadvantaged women.

The Museveni government is leveraging the GROW project to help women grow and expand their businesses through increased access to affordable credit, training, skills development and other business development-related services.

The idea is to impact women-owned or controlled business enterprises in 136 districts, 11 Cities and 13 refugee-hosting districts. The project is designed in such a way that at least 5% of the financial assistance is ring-fenced to benefit refugees. A review of the PSFU-spearheaded GROW project aspects reveals that primary beneficiaries have to be women entrepreneurs, female refugees and Ugandan women in refugee-hosting districts.

It’s ideal that female entrepreneurs benefiting from GROW project funds are invested in women-dominated sectors like tourism, hospitality, catering, trade, education, health, textiles, garments, leather products and agriculture. President Museveni also desires to see the GROW project funds used to, in a special way, emancipate women entrepreneurs seeking to transition or break into traditionally male-dominated sectors or fields like manufacturing, construction, the ICTs plus oil & gas.

GROW project funds or support should enable women-owned business enterprises that are micro to grow into small size business enterprises and those that are small to grow into medium size. It’s also about increasing productivity under the female-owned business enterprises.

Within the five years of the project, the idea is to support 35,000 micros and 4,000 small ones to grow and expand into something bigger. Visionary as always, President Museveni hopes to create 295,000 direct jobs and 1,180,000 indirect ones during the PSFU-driven GROW project’s five years of existence.

A total of 60,000 women-owned business enterprises is to be impacted in the five years of GROW project. 5% or 3,000 of these have to be refugee-owned businesses. A total of 280,000 individual women entrepreneurs is targeted to be directly impacted or covered by GROW project funds (42,000 of whom have to be refugees and another 14,000 women from refugee-hosting districts/cities).

The GoU is targeting to impact a total of 1.6m indirect beneficiaries within the 5 years. These can be male employees or co-owners, male spousal partners, community members, household members and the resultant job creation beneficiaries.

Besides the access to affordable credit-related support, GROW project also seeks to amplify women business enterprises through availing them with business/trading management skills and expertise-all at no cost. Offered at contracted training institutions like Mubs and Enterprise Uganda etc, GROW project beneficiaries are also facilitated to undergo trading sector-specific skills acquisition-all at no cost.

At the end of such training and skilling, the beneficiaries are also certified, which speaks to the certification component of the project. Besides training and support on the documentation and record keeping, beneficiaries are also sensitized about sustainable loan products accessible or obtainable at the six GROW-Participating Financial Institutions (PFIs). These include the following banks: Centenary, Equity, DFCU, Finance Trust, Stanbic and Post Bank.

Through the GROW project implementation, the GoU has also been enabled to generate data-backed evidence relating to the number of women entrepreneurs out there who qualify for and are in need of such support and emancipation. Through the same GROW project, the Museveni government has also been able to support hundreds of women to deepen their hands-on skilling through industry-specific placements and apprenticeship programs.

Here is a simple illustration: a young lady desiring to venture into restaurant business can be placed to work with a big hotel for say six months to become hands-on and learn best industry practices, while earning a GROW-offered monthly allowance of Shs1m per month. At the end of the 6 months apprenticeship period, that future restaurant owner (if serious) will have saved that Shs6m which she can use to boost the start of her own restaurant business.

There are also grant-earning opportunities under GROW for women entrepreneurs who participate in say business proposal-writing competitions and emerge victorious.

Under GROW, women are also exposed to mindset change clubs which in the end facilitate or enable peer learning. There is also a component on accelerating access to common user facilities, multi-purpose services and shared production facilities plus other gender-sensitive workplace infrastructure; all of which combine to enhance productivity among the project-targeted female entrepreneurs.

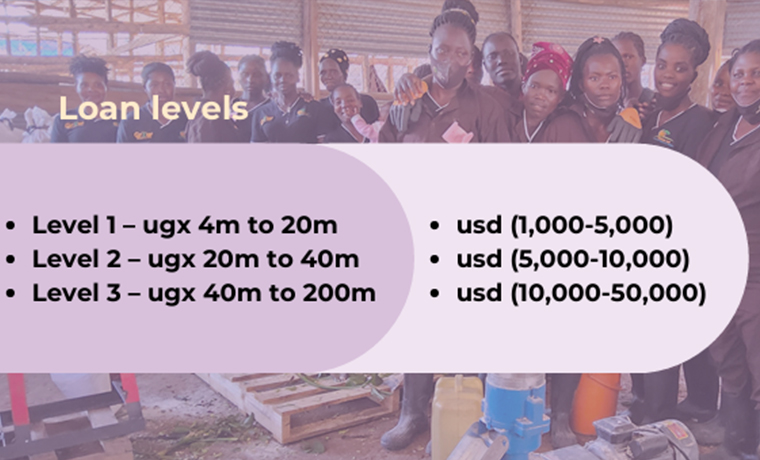

LEVELS OF BORROWING:

There are three levels of borrowing namely level one, which caters for female entrepreneurs eligible to borrow between Shs4m and Shs20m. There is also level two which caters for borrowers of Shs20-40m and finally level three, catering for borrowers of Shs40-200m.

Whereas the launching of the project had been done earlier on by President Woman himself during the International Women’s Day celebrations, the actual disbursement of the affordable loans under the GROW project began at the beginning of this year 2025. The GoU disburses the cash to borrowers, who have been assessed to be eligible, through the six Participating Financial Institutions (Centenary, DFCU, Finance Trust, Equity, Stanbic and Post Bank).

WOMEN ENTREPRENEURS GETTING THE MONEY:

Available government literature that has been reviewed by this news publication shows that as of July 2025, a total of Shs120bn had been approved through the GoU approval processes to be disbursed or lent out to eligible borrowers through the 6 PFIs, which initially have a two-year project implementation agreement with the GoU.

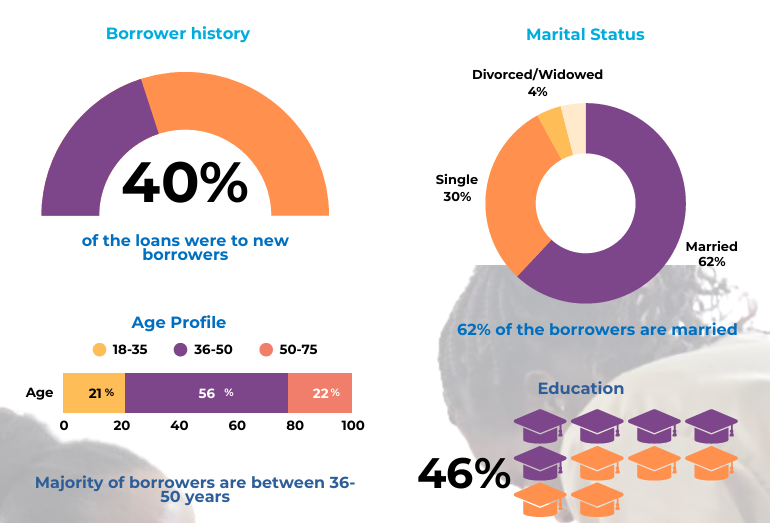

It was targeted that a total of 4,007 women-owned/controlled business enterprises would be impacted or given the money within the first one year by the PFIs. 458 of these had to be refugees or women in RHDs. As of June 2025, a total of 2,958 GROW loans had been given out. Of these, 75% or 2,120 went to level one borrowers (falling under between Shs4m and Shs20m). 441 (14.9%) were level two (20-40m) and another 397 (13.4%) were level three (40-200m).

Banks or PFIs performed as follows: Centenary gave out 1,097 loans as at June 2025; DFCU 219, Equity Bank 167, Finance Trust 753, Stanbic 13 and Post Bank 709. As of June, a total of 6 borrowers had done so well with the borrowed money (taken out at very affordable interest of 10%) that they qualified for second loan within just 6 months of taking out the first loan under the PSFU-driven aspects of GROW project.

Talking about districts, the GROW project intervention was present and impacting women entrepreneurs and the targeted business enterprises within 113 districts and 8 cities as of June 2025.

And gratefully, the other remarkable thing evidencing the extent to which GROW project is doing well relates to the fact that, as of June 2025, successful borrowers had managed to pay back a total of Shs26bn (constituting 21.6%) and thereby enabling the Trust Towers-based Secretariat (closely working with the 6 PFIs) to have the cash available to support another subsequent set of borrowers.

In fact, the reviewed literature shows that of the Shs73.3bn that had been disbursed or lent out as at June 2025, Shs26bn was from GROW project repayments. All said and done, loans packaged/available under level one (4m-20m) had so far been the best performing and most impactful as of June.

Whereas the Secretariat’s target was to have given out 1,997 level one loans (as of June), 2,120 had been disbursed (representing an over performance at 106.2%). 441 or 38.7% had been given out under level 2 (20-40m) against the set target of 1,139 loans. Under level 3, of the targeted 431, a total of 397 (or 92%) had been disbursed as of June 2025. Overall, 2,968 (74%) loans disbursement rate was achieved under the three levels, against the set target of 4,007 loans.

The other remarkable impact is that GROW project has helped accelerate the government’s long-stated objective of deepening financial inclusion. This is illustrated by the fact that whereas 98% of the borrowers (overall) were individual women entrepreneurs, 28% of them were new borrowers, coming to the bank and borrowing for the first time. This simply means these were people becoming bank customers for the first time in order to qualify to access GROW project loans through any of the 6 PFIs.

The other interesting statistics is that 42.2% of the borrowers were in trading activities, against the 27.9% who borrowed to boost their enterprises in agriculture and agro-processing; 9.2% in construction & engineering and finally 8.5% in business and financial services.

The refugees are being impacted as well because of the 2,958 loans that were given out overall, 6 of them went to refugees (as of June 2025) and Shs38m was involved. And it was disbursed through Centenary bank. 5 of these refugee borrowers were urban refugees from Kampala and the other remaining one was from Koboko and took out Shs20m. All the refugee borrowers were under level one (4-20m).

In the RHDs, the number of loans issued to non-refugee business entrepreneurs stood at 159 as of June. The beneficiaries were from the 9 refugee hosting districts with exception of Madi-Okollo, Obongi and Terego.

The GROW project has also greatly helped to incentivize the women with disabilities (female PWDs) to get involved into the money economy and the financial inclusion space in order to get emancipated into more viable business entrepreneurs. This is so because as of June, a total of 6 female PWDs-owned businesses had received the GROW project loans (6 through Centenary Bank, 2 Finance Trust and one Post Bank). All of them borrowed under level one (4-20m).

When it comes to the minority communities, a total of 8 GROW project loans had as of June been taken out by the Benet woman through Post Bank, representing only 0.4% of the total of 2,958 loans that had been disbursed thus far as of that time. The other remarkable thing observable from the reviewed literature is that 55% of the PSFU-enabled GROW loans borrowers were (as of June 2025) aged between 31 and 55 years. And more than 55% of these were married people.

WHAT HAS BEEN REGRETTABLE SO FAR:

In the very first months of rolling out the Shs120bn which the GoU had approved for disbursement, up to 70% of the borrowers had been from the Greater Kampala Metropolitan Area, something which the President didn’t like.

For their own business convenience, the six PFIs or banks had preferred lending to Kampala-based borrowers because they were found to have higher levels of financial literacy and therefore easier to recover the disbursed monies from.

A displeased Museveni protested this and guided in one of the Cabinet meetings where the GROW project implementation was discussed. His guidance was that disbursement must deliberately be decentralized so that his beloved GROW project impacts people in different parts of the country, and not just Kampala.

Always there for the muntu wa wansi (the ordinary person), Museveni guided on how this identified mischief could be cured. He told Cabinet that he knows that some of those very hardworking and modestly-successful female entrepreneurs are easily intimidated by the many bureaucratic procedures and requirements the banks put on borrowers. To him, this is why banks had found it convenient and viable to concentrate much of the lending in the Kampala area.

He directed that the line Ministers work with the GROW project Secretariat to make sure that SACCOs, which tend to be more friendly and less-intimidating, are used or engaged to effect decentralisation of the GROW project loans disbursement. That’s how reputable World Bank-acceptable SACCOs like CBS’ PEWOSA, UGAFODE and others have since been engaged to come on board to improve coverage in non-Kampala areas to which the 6 PFIs/banks would ordinarily not be attracted because of business viability concerns.

The President guided that such SACCOs eliminate the requirement for collateral when giving out the GROW loans and instead leverage the arrangement of group guarantees. One’s membership to the SACCO should be sufficient guarantee for the loan repayment. The big man from Rwakitura decreed that this arrangement should be applicable to all GROW project loans where an individual borrower is taking not more than Shs30m.

The President rightly believes that involving the SACCOs and relaxing on the collateral security-related requirements will increase coverage and enable the GoU have the GROW intervention reach the targeted beneficiaries in many more districts and cities of Uganda instead of ending up being a Kampala-based thing.

At the instigation of the President, institutions like Pride Microfinance and Opportunity Bank too have had to be brought on board under the enlarged PFIs’ list. Any female Ugandan entrepreneur and therefore desirous to learn more about the GROW project loans is encouraged to either physically visit the PSFU/GROW project Secretariat at Trust Towers in Nakasero or directly reach out through the relevant toll-free line, which is 0800307777. (For comments on this story, get back to us on 0705579994 [WhatsApp line], 0779411734 & 041 4674611 or email us at mulengeranews@gmail.com).