By Mulengera Reporters

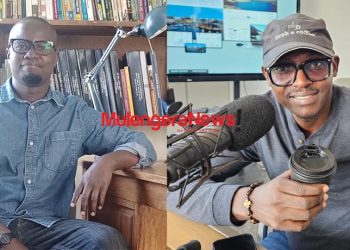

Mr. Robert Wamala Lumanyika, the URA’s Acting Manager for Tax Education Content, has called on creatives across the country to formalize their work and understand how taxation affects their earnings, warning that ignorance could lock many out of the growing digital economy.

Speaking at the Digital Distribution for Creative Content Programme in Jinja City Hall, Lumanyika addressed musicians, actors, content creators, comedians, and producers gathered for the high-profile engagement organized by UgaTunes.

“There’s no one-size-fits-all in taxation. How you register, whether as an individual, partnership, or company, determines how you are taxed,” Lumanyika emphasized, urging the creatives to stop operating in the shadows if they want to benefit from national programs.

He explained that URA is not out to frustrate talent but rather to guide them into the formal economy where they can access government support, funding opportunities, and legal protection for their content.

Many participants raised questions about how taxes are used and what direct benefits creatives get in return.

In response, Lumanyika acknowledged the concerns, saying URA is committed to transparency and ensuring Ugandan creatives are not left behind.

“We want creatives to see themselves as businesspeople who are just as important as anyone in other sectors,” he said if you don’t formalize, someone else will make money off your work while you remain stuck.”

The engagement, which follows a successful session in Gulu, is part of a wider national campaign in partnership with the Microfinance Support Centre, UCC, Afro Mobile, and UCUSAF.

In a practical and passionate, tone, Lumanyika drove home the message that the digital wave will not wait for anyone.

“Let’s organize our craft, or we will keep watching others succeed off our talent,” he advised. (For comments on this story, get back to us on 0705579994 [WhatsApp line], 0779411734 & 041 4674611 or email us at mulengeranews@gmail.com).