By Mulengera News

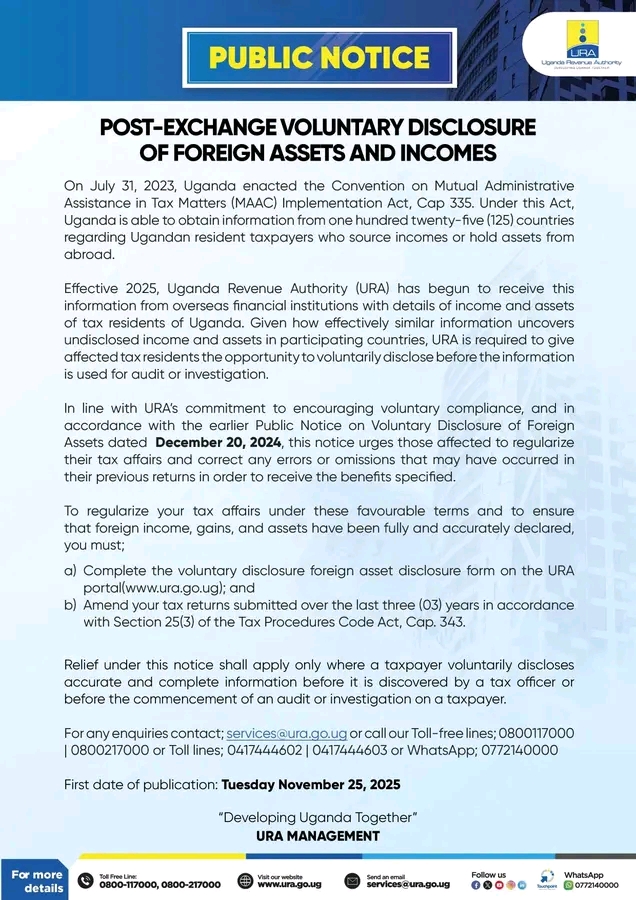

If you’re a tax resident of Uganda with foreign assets or income, this is your reminder: the clock is ticking. A critical notice from the Uganda Revenue Authority (URA), first issued on November 27, 2025, could hold the key to ensuring your financial affairs are fully compliant.

With the URA now receiving information from over 125 countries about the foreign assets and income of Ugandans, it’s no longer safe to assume that your overseas finances are under the radar.

Under the Convention on Mutual Administrative Assistance in Tax Matters (MAAC), Uganda has begun receiving detailed financial data from international financial institutions, giving the URA access to reports on assets and income held abroad by tax residents. This means that if you have not already disclosed foreign assets or income, the URA may already have that information.

But there’s still an opportunity to get things right. The URA has announced a voluntary disclosure program, allowing Ugandans to come forward and correct any omissions or errors in their past tax returns but only before an audit or investigation begins. Once the URA starts an investigation, it will be too late to avoid penalties.

This is the perfect chance to avoid hefty fines or legal complications. If you haven’t declared all your foreign income or assets, the URA is giving you a chance to fix it without facing severe penalties, as long as the information you provide is accurate and complete. The voluntary disclosure will apply only if you act before the URA launches an audit or investigation into your tax affairs.

Taxpayers who wish to regularize their foreign tax returns must go to the URA portal to submit the voluntary disclosure form. Additionally, if you’ve filed tax returns in the last three years and didn’t report foreign assets or income, now is the time to amend those returns. The window to act is closing, and failure to disclose could result in significant legal consequences.

For those who need assistance or have questions, URA has made it easy to reach out. Whether through the toll-free hotline, WhatsApp, or email, the authority is available to provide support and guidance.

If you have foreign income or assets, don’t wait for the URA to come knocking. Now is the time to regularize your tax affairs and ensure your financial activities are fully compliant. The opportunity to avoid penalties and audits won’t last forever.

For more information or assistance, you can contact the URA through their toll-free numbers: 0800117000 or 0800217000. Alternatively, you can reach out via WhatsApp at 0772140000 or email [services@ura.go.ug](mailto:services@ura.go.ug). Visit their website at [www.ura.go.ug](http://www.ura.go.ug) for more details.