By Aggrey Baba

By Aggrey Baba

Grace Foam, a Chinese-owned company operating in the Tangshan Mbale Industrial Park, is at the center of a brewing tax scandal over allegations of benefiting from over UGX 17 billion in discriminatory tax exemptions.

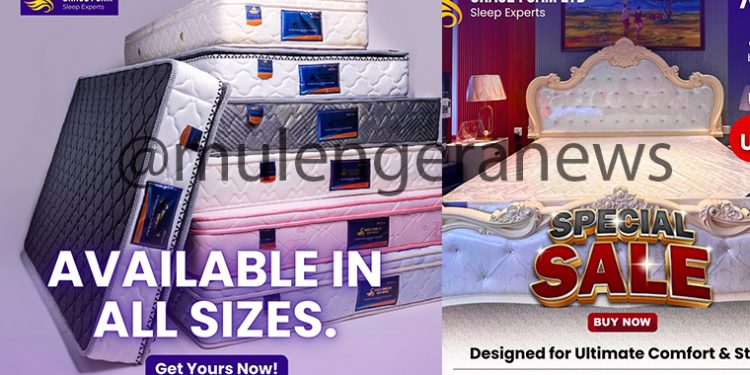

The firm, which specializes in foam products including mattresses and beddings, is accused of exploiting Uganda’s investment incentives at the expense of local manufacturers who do not enjoy the same benefits.

The controversy was sparked by a formal protest lodged by a leading Ugandan textile and foam manufacturer, which operates a vertically integrated facility in Jinja.

The company, which has chosen not to be publicly identified, accuses the Ministry of Finance of extending favorable tax treatment to Grace Foam, giving it an unfair market advantage.

The protest, filed through Kampala Associated Advocates (KAA), claims that while the Jinja-based, and other companies undertakes full-scale local production, that’s to say from importing raw materials to final product manufacturing, Grace Foam simply imports finished products and repackages them as “Made in Uganda” to qualify for tax breaks.

Grace Foam, operating under the umbrella of Tangshan Mbale Industrial Park, is said to be taking advantage of generous tax incentives provided under the industrial park scheme, despite allegedly offering little to no value addition within Uganda.

This includes tax exemptions on imported finished foam products, while Ugandan firms engaged in actual manufacturing processes are subjected to heavy taxes on raw materials.

According to the protest letter, the local firm employs over 1,200 Ugandans and has made significant investments in machinery, processing, dyeing, and finishing, all within Uganda. Despite this, the company pays up to 35% in import duties on inputs such as grey fabrics and chemicals, amounting to UGX 24 Billion a year, while Grace Foam avoids similar charges.

Industry observers warn that such policy discrepancies threaten to undermine Uganda’s broader industrialization agenda.

“It is unjust for a company that imports ready-made products to be treated the same, or even more favorably, than one that adds real value within Uganda,” reads part of the complaint.

The complaint further points out that branding foreign imports as “Made in Uganda” not only deceives consumers but also erodes trust in the “Buy Uganda Build Uganda” (BUBU) initiative.

Despite employing far fewer Ugandans and adding limited local value, Grace Foam reportedly enjoys unrestricted tax incentives simply by virtue of being located within an industrial park.

This has sparked growing concern among local investors who feel disadvantaged by a system meant to support domestic manufacturing.

The Ministry of Finance has yet to respond to the allegations. However, pressure is mounting for a review of Uganda’s tax incentive framework to ensure that it genuinely promotes local industry rather than enabling what critics describe as “tax tourism.”

As investigations unfold, stakeholders are calling on the government to uphold transparency and fairness in the application of investment policies, or risk undermining the very economy they aim to grow. This is a developing story. (For comments on this story, get back to us on 0705579994 [WhatsApp line], 0779411734 & 041 4674611 or email us at mulengeranews@gmail.com).