By Musa Mbogo

Airtel Money has joined forces with Juba Express, a licensed international payment service provider, to introduce a seamless cross-border money transfer service accessible directly through the Airtel Money wallet.

This strategic partnership is aimed at broadening the global reach of remittances while making international transfers more affordable for millions of Ugandans.

The move comes at a critical time, as remittances continue to play a vital role in Uganda’s economy.

According to the World Bank’s 2024 Migration and Development Brief, Sub-Saharan Africa received USD 54 billion in remittances in 2023, with Uganda alone receiving roughly USD 1.2 billion.

This figure grew to USD 1.42 billion by January 2024, underlining the importance of money sent home by Ugandans living and working abroad.

These funds support essential household needs, including education, healthcare, and small business investments, making cross-border transfers a crucial economic lifeline.

Through the new service, Airtel Money users can make international transfers in real time, at low cost, and with transparent foreign exchange rates.

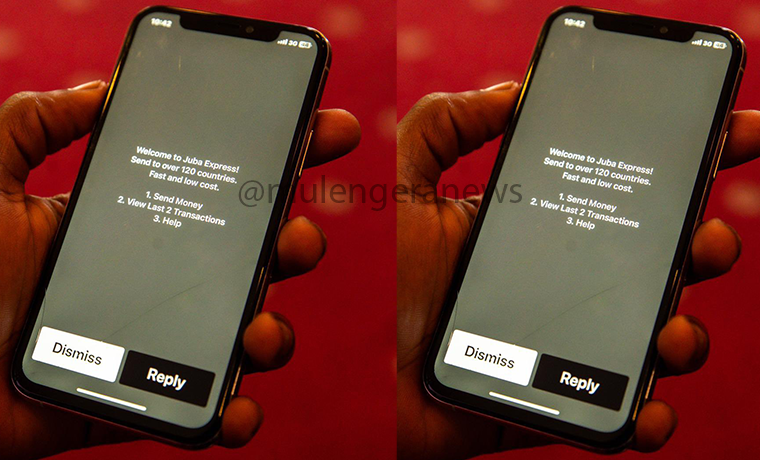

The service is designed to be user-friendly, accessible directly through the Airtel Money USSD menu. Customers can dial 185#, navigate to “Send Money → International Transfers → Juba Express,” and complete their transactions within minutes.

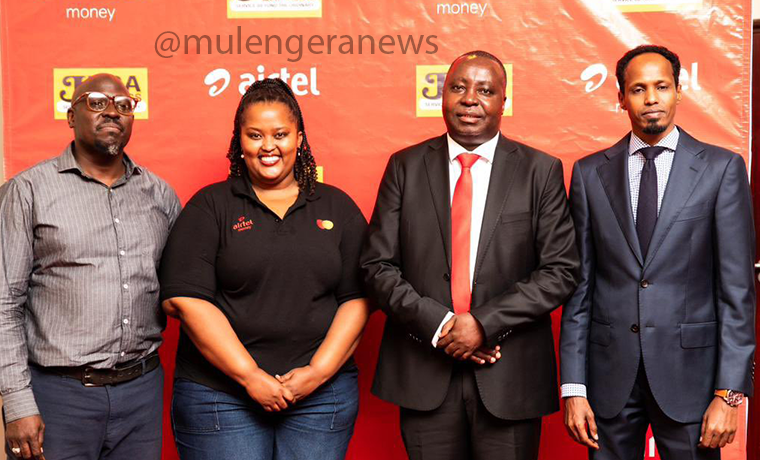

Speaking at the launch, Japeth Aritho, Managing Director of Airtel Money, highlighted the significance of the initiative.

“In an increasingly interconnected world, the need to send money across borders is more critical than ever. Whether it’s parents paying school fees, families supporting loved ones, or businesses making crucial payments, cross-border transactions are the lifeblood of our global community,” he said.

“Through our partnership with Juba Express, Airtel Money is making international transfers faster, safer, and more affordable for our customers.”

The service allows users to transfer money instantly and securely to over 120 countries. Transaction fees start from Shs 120, with a maximum transfer limit of Shs 5 million per transaction.

The service is fully regulated by the Bank of Uganda, providing customers with a reliable and transparent platform for international money movement.

Sitati Dawo from Juba Express described the collaboration as a significant milestone in improving financial inclusion.

“Partnering with Airtel Money allows us to extend our mission of providing affordable, secure, and efficient money transfers to millions of Ugandans, enabling them to support families, run businesses, and seize opportunities across borders,” he said.

Financial experts say the partnership could reshape how Ugandans access international money transfer services.

By integrating Juba Express’ global reach with Airtel Money’s extensive mobile network, users can now send funds across borders without relying on traditional banking channels, which are often slower and more expensive.

In addition to individual remittances, businesses are expected to benefit from the service, as it facilitates quick payments to suppliers, partners, and service providers overseas.

The move also strengthens Uganda’s reputation as a leader in digital financial innovation, making it easier for citizens to participate in the global economy regardless of their location. (For comments on this story, get back to us on 0705579994 [WhatsApp line], 0779411734 & 041 4674611 or email us at mulengeranews@gmail.com).