By Mulengera Reporters

By Mulengera Reporters

As Ugandan students prepare to head back to school for the new academic year, the financial challenges of education continue to weigh heavily on many families. The costs of tuition fees, uniforms, books, and other essentials often create significant strain, forcing parents to seek ways to meet these expenses. In response, several banks in Uganda—including Housing Finance Bank, DFCU, Diamond Trust Bank, FINCA, ABSA, Centenary Bank, and Equity Bank—have launched “Back to School” promotions designed to alleviate some of this burden. These promotions typically include financial products, such as loans with flexible repayment options, to help families manage the costs.

The education system in Uganda is a cornerstone for the country’s future, but for many, it remains financially inaccessible. Over 80% of Ugandan families live below the poverty line, and the cost of educating a child can be overwhelming—especially at the start of a new school year. For many parents, this means relying on loans or depleting savings that may not even exist, just to cover tuition fees, books, and school supplies.

While the Government of Uganda has made significant strides in improving access to education through programs like Universal Primary Education (UPE) and Universal Secondary Education (USE), these initiatives have not fully removed the financial burdens associated with schooling. UPE and USE have been instrumental in ensuring that every Ugandan child has access to primary and secondary education, regardless of financial background. However, many families still face additional costs such as uniforms, transportation, and other school-related expenses, which can be just as overwhelming as tuition. In this context, financial institutions have stepped in to help bridge the gap.

To address these rising education-related costs, several banks have introduced tailored loan products. For example, DFCU Bank’s “Back to School Loan” offers reduced interest rates and extended repayment periods, making it a more affordable option for families. Similarly, Equity Bank’s “Flexi Loan” provides easy access to funds with minimal documentation. ABSA Bank has also joined the initiative, offering promotional financial products aimed at easing the back-to-school financial burden. Housing Finance Bank’s “School Fees Loan” stands out by offering up to UGX 5 million with no collateral and a 3-month repayment period, providing a flexible solution for parents to cover school fees without worrying about long-term debt.

However, while these loans can provide much-needed short-term relief, they come with potential risks. Hidden fees, fluctuating interest rates, and repayment schedules that may become overwhelming could exacerbate the financial strain on families already struggling to make ends meet. This highlights the need for careful consideration before taking on any loan product.

Beyond the immediate relief provided by loans, there is also a critical need for improved financial literacy among Ugandans. Many families may not fully understand the terms, conditions, or potential implications of these financial products. Without proper understanding, even well-meaning loans can lead to greater financial hardship in the long run. It is essential that banks prioritize customer education, ensuring families are well-informed about how these products work, including the full extent of their obligations. Clear, transparent communication is key to ensuring these promotions genuinely help without creating new financial problems.

As Uganda’s banking sector continues to offer loan products aimed at addressing education-related costs, financial institutions must also invest in civic education to empower the public with better financial management skills. This would reduce the risk of families falling into debt traps and encourage long-term financial planning. By fostering a better understanding of budgeting, saving, and borrowing, Ugandans will be better equipped to make informed financial decisions.

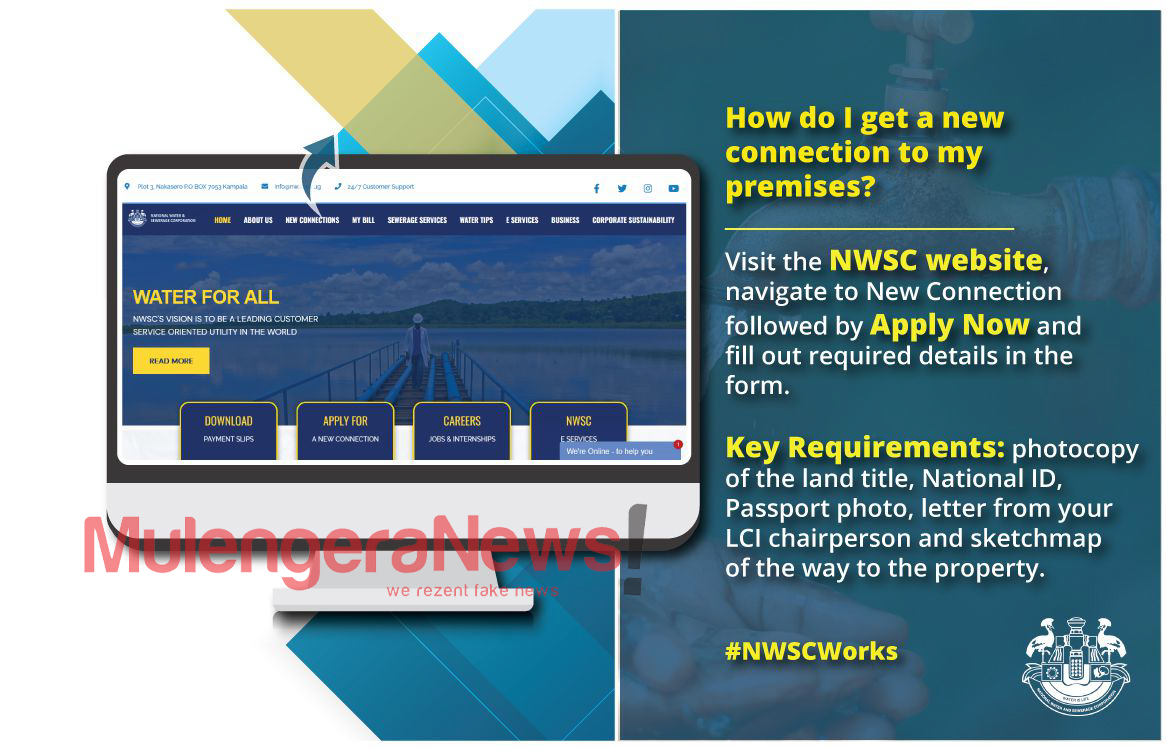

In an era where digital banking is becoming more accessible, innovations like Housing Finance Bank’s School Pay can serve as a model for how financial institutions can address the real needs of everyday citizens. This approach goes beyond a mere marketing strategy—it is a practical, customer-friendly solution that simplifies school fee payments in today’s economic climate.

Ultimately, the true measure of success for any back-to-school promotion should not be the number of customers a bank acquires or the revenue it generates, but how effectively it helps families overcome financial hurdles and secure a better future for their children. As the government continues to build on the successes of UPE and USE, it is equally important to recognize that the private sector has a vital role to play in developing sustainable solutions that empower families and support Uganda’s broader educational goals. (For comments on this story, get back to us on 0705579994 [WhatsApp line], 0779411734 & 041 4674611 or email us at mulengeranews@gmail.com).