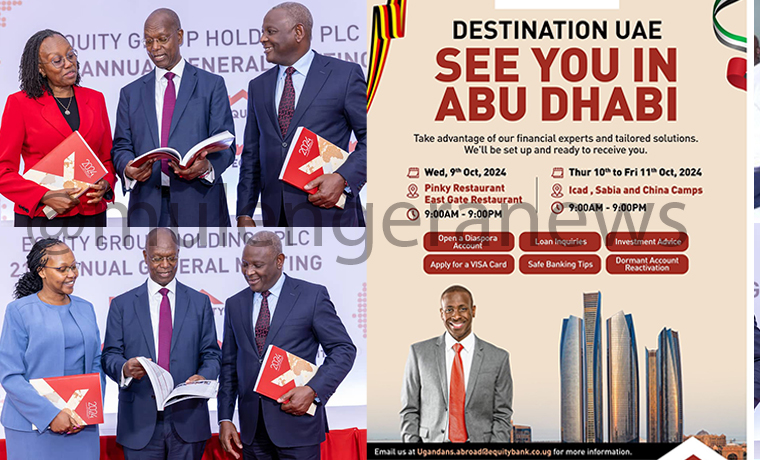

Equity Group has received shareholder approval to open a Representative Office in the United Arab Emirates (UAE), a historic move that signals the bank’s strategic expansion beyond Africa and into global markets.The decision was ratified during the bank’s 21st Annual General Meeting held on June 25, 2025.

Once regulatory approvals are granted by the Central Bank of Kenya and UAE authorities, the new office.(expected to begin operations in early 2026) will serve as a gateway connecting East and Central Africa to the UAE, Middle East, India, Central Asia, and South Asia.

For thousands of Equity Bank Uganda customers living and working in Dubai, the UAE, and Saudi Arabia, the new office is set to offer a game-changing alternative to the costly and often inconvenient informal banking methods they’ve had to rely on for years.

The UAE Representative Office will provide direct customer support for diaspora banking, trade facilitation, capital raising, and supply-chain finance services, as well as help streamline remittances and mobile money services, tools that are essential for East Africans abroad looking to send money home or invest in their countries of origin.

This expansion builds on Equity Bank Uganda’s recent outreach efforts in the Gulf region. Over the past few years, the bank’s service and management teams have conducted diaspora engagement visits to Dubai and Saudi Arabia, offering financial services tailored to the unique needs of Ugandans abroad.

These included personalized advisory services on remittances, savings, and investment—initiatives that were well received by the diaspora community.

According to Dr. James Mwangi, Group Managing Director, the new office will support Equity’s vision of becoming Africa’s “one-stop financial services platform.”

It also aims to open doors for Gulf-based investors interested in East Africa’s rapidly growing sectors such as agribusiness, infrastructure, and energy, industries where many Ugandan expatriates are already actively investing.

For the Ugandan diaspora, especially laborers, entrepreneurs, and professionals in the Gulf, this development promises not just convenience but also empowerment, bridging the gap between where they work and where they want to invest, transforming financial access and connectivity across borders

Equity Group has received shareholder approval to open a Representative Office in the United Arab Emirates (UAE), a historic move that signals the bank’s strategic expansion beyond Africa and into global markets.

The decision was ratified during the bank’s 21st Annual General Meeting held on June 25, 2025.

Once regulatory approvals are granted by the Central Bank of Kenya and UAE authorities, the new office.(expected to begin operations in early 2026) will serve as a gateway connecting East and Central Africa to the UAE, Middle East, India, Central Asia, and South Asia.

For thousands of Equity Bank Uganda customers living and working in Dubai, the UAE, and Saudi Arabia, the new office is set to offer a game-changing alternative to the costly and often inconvenient informal banking methods they’ve had to rely on for years.

The UAE Representative Office will provide direct customer support for diaspora banking, trade facilitation, capital raising, and supply-chain finance services, as well as help streamline remittances and mobile money services, tools that are essential for East Africans abroad looking to send money home or invest in their countries of origin.

This expansion builds on Equity Bank Uganda’s recent outreach efforts in the Gulf region. Over the past few years, the bank’s service and management teams have conducted diaspora engagement visits to Dubai and Saudi Arabia, offering financial services tailored to the unique needs of Ugandans abroad.

These included personalized advisory services on remittances, savings, and investment, initiatives that were well received by the diaspora community.

According to Dr. James Mwangi, Group Managing Director, the new office will support Equity’s vision of becoming Africa’s “one-stop financial services platform.”

It also aims to open doors for Gulf-based investors interested in East Africa’s rapidly growing sectors such as agribusiness, infrastructure, and energy, industries where many Ugandan expatriates are already actively investing.

For the Ugandan diaspora, especially laborers, entrepreneurs, and professionals in the Gulf, this development promises not just convenience but also empowerment, bridging the gap between where they work and where they want to invest, transforming financial access and connectivity across borders. (For comments on this story, get back to us on 0705579994 [WhatsApp line], 0779411734 & 041 4674611 or email us at mulengeranews@gmail.com).